Embedded working capital and unlimited liquidity will enhance the breadth of the Bankable banking infrastructure core proposition.

London, UK– 15th of June 2023 – Bankable, a pioneer in the Banking-as-a-service industry, today announced the acquisition of Arex Markets, giving the combined company the ability to embed credit and working capital into the payment flows of established neobanks, multinational brands and fintech platforms. Arex Markets’ proprietary technology enables investors to finance a variety of commercial papers to seamlessly speed up payment flows and ease the working capital challenge.

As BaaS and embedded finance solutions continue to proliferate, the B2B finance space continues to struggle with quick and flexible access to liquidity solutions, whilst investors continue to search for the right balance between risk and yield. The legacy banking system has not been able to provide the ability to offer credit and working capital solutions which can be embedded in transactional flows as diverse as accounts payable, invoicing, cards issuing and cross border supplier payments. Which forces businesses to consider alternative private financiers or carrying additional costs on their balance sheet.

Bankable will add working capital (flexible invoice financing , corporate credit cards, lodged cards and revolving credit) to the existing API-first digital platform. Customers will have the ability to become ‘Bankable’ and build cards, payments, and credit solutions on top of the Bankable virtual account core in minutes. Through extensive investor partnerships, Bankable can offer unlimited working capital matched with an extensive portfolio of relevant customers. Early use cases for the combined offering are being rolled out in the B2B wholesale travel sector for working capital support on supplier payments; supporting pan-European scale-up fintechs and neo-banks to take the next step in building net new revenues from credit cards; and working with global consumer brands to establish a single payments solution tailored to their needs.

Core to the Bankable approach is working as a friend to the established banking industry and Bankable is working closely with several tier 1 institutions to welcome them as new investors on to the platform providing them with an additional route to deploy capital quickly and flexibly.

Eric Mouilleron, CEO & founder of Bankable: “Together with Arex Markets, we share the same entrepreneurial culture and ambition. Thanks to our complementary assets and strong alignment of our teams, we can attract premium clients seeking to develop a uniform pan-European banking offer leveraging our best-in-class API platform including credit. This partnership clearly sets us up with the richest Bank as a Service offer for premium clients with clear multi-country ambitions.”

Airto Vienola, CEO of Arex Markets, added: “Bankable and Arex share the same mission: to offer embedded financial services across Europe to fintechs, established businesses and brands. Together with Bankable, we offer both a formidable infrastructure powered by the best technology that gives access to banking-related services that are modular and easy to integrate, and the deepest product breadth in the Bank-as-a-Service European market, covering accounts, cards and credit.”

________________________________________________________________

About Bankable:

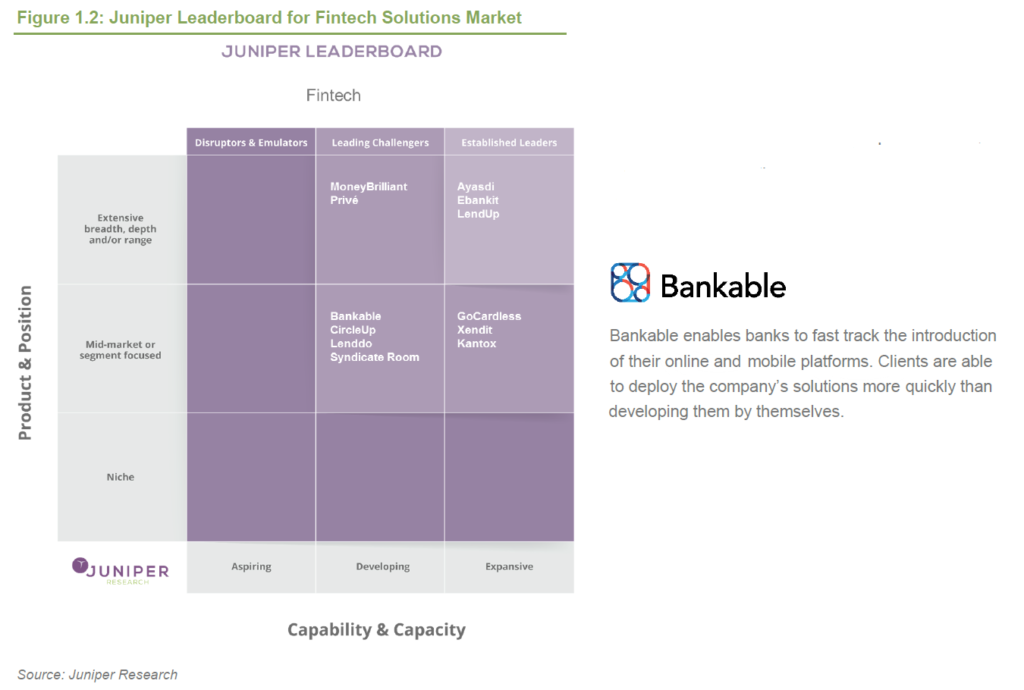

Bankable is a global digital core banking platform and Banking as a Service provider. We help financial institutions, corporates and fintech deploy, orchestrate, and operate highly differentiated payment solutions with quick time to market.

About Arex Markets

AREX Market operates a marketplace connecting businesses with institutional investors unlocking capital by giving them access to an entire suite of credit solutions. AREX’s mission is to drive the cost of financing down so hard-working businesses can retain more of their money and focus on their business.

Bankable contact: pr@bnkbl.com